|

|

|

|---|

|

|

|

|---|---|---|

|

|

|

|

|

|

|---|---|---|

|

|

|

|

Understanding Bankruptcy Chapter 7 in Jacksonville, FL: A Comprehensive Guide

What is Chapter 7 Bankruptcy?

Chapter 7 bankruptcy, often referred to as 'liquidation bankruptcy,' is a legal process that allows individuals to eliminate most of their debts and start anew. This type of bankruptcy is available to individuals, couples, and businesses in Jacksonville, FL.

Eligibility Criteria

To file for Chapter 7 bankruptcy in Jacksonville, you must meet certain eligibility criteria:

- Pass the means test to ensure your income is below the state median.

- Complete a credit counseling course from an approved agency.

- Have not filed a Chapter 7 bankruptcy within the last eight years.

Exemptions in Florida

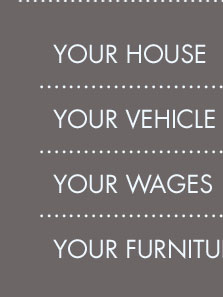

Florida law provides several exemptions that allow you to keep certain assets:

- Homestead exemption - Unlimited value for a primary residence.

- Personal property - Up to $1,000 in personal property.

- Vehicle exemption - Up to $1,000 in equity of a vehicle.

The Filing Process

The process of filing for Chapter 7 bankruptcy in Jacksonville involves several steps:

Preparation and Documentation

Gather all necessary financial documents, including tax returns, income statements, and lists of assets and debts.

Filing the Petition

Submit the bankruptcy petition, along with schedules of assets, liabilities, and other required forms, to the court.

The Role of a Trustee

A court-appointed trustee will oversee your case, liquidate non-exempt assets, and distribute the proceeds to creditors.

For professional assistance, consider consulting a south florida bankruptcy attorney to guide you through the process.

Benefits of Chapter 7 Bankruptcy

Filing for Chapter 7 bankruptcy can provide significant relief and benefits:

- Debt Discharge - Most unsecured debts, such as credit card debt and medical bills, can be eliminated.

- Automatic Stay - An immediate halt to creditor harassment and collection actions.

- Fresh Start - Opportunity to rebuild your financial life without the burden of overwhelming debt.

Frequently Asked Questions

What debts are not dischargeable in Chapter 7 bankruptcy?

Certain debts, such as student loans, child support, alimony, and some taxes, are not dischargeable under Chapter 7 bankruptcy.

How long does the Chapter 7 bankruptcy process take?

The Chapter 7 bankruptcy process typically takes about four to six months from the date of filing to the discharge of debts.

Can I keep my house if I file for Chapter 7 bankruptcy in Florida?

Yes, Florida's homestead exemption allows you to keep your home if it qualifies as your primary residence, regardless of its value.

If you are considering bankruptcy options outside Florida, you might find the services of utah bankruptcy lawyers helpful.

For a Chapter 7 bankruptcy in Jacksonville, you must show that you do not have the financial ability to pay your debts. The Bankruptcy code calls for an ...

Bankruptcy Video - Change of Address - Credit Counseling / Debtor Education - Emotional Support - Filing a Chapter 7 case - Filing a Chapter 11 case - Filing a ...

At Adam Law Group, we have bankruptcy attorneys who help with debt relief. Our years of legal experience have helped countless individuals and families set ...

![]()